Last month, ERCOT launched a new ancillary service product called ERCOT Contingency Reserve Service (ECRS). ERCOT will leverage ECRS to address various grid stabilizing efforts including:

- To restore frequency within 10 minutes of a significant frequency deviation

- To compensate for intra-hour net load forecast uncertainty and variability on days in which large amounts of online thermal ramping capability is not available

- When there is limited amount of capacity available via SCED

ERCOT’s minimum procurement level for ECRS is based on the sum of (i) capacity needed to recover frequency following a large unit trip and (ii) 85th to 95th percentile of 30 minutes ahead intra-hour net load forecast error.

What is the impact on storage?

ECRS represents a new avenue for energy storage resources (ESRs) to provide value to ERCOT and be compensated for that.

Since launching ECRS on the June 10th operating day, ERCOT has consistently procured over 2GW of capacity for ECRS each operating hour. Likewise, the capacity price for ECRS has typically cleared higher than ERCOT’s other ancillary service products, including RRS and Reg Up (see graph below).

How does ECRS compare to RRS?

For storage assets operating in ERCOT, the vast majority of revenue to date has come from providing RRS. We are seeing ECRS clear at a higher price than RRS and ERCOT procure a similar volume of each…so storage developers and operators should just switch to ECRS right?

Well it’s not that simple. ERCOT has different operating requirements for ECRS vs. RRS that impact the optimal allocation between the two products.

Duration Requirement

ERCOT has a two hour sustained capability requirement for ECRS vs. a one hour requirement for RRS. This requires resources providing ECRS to limit their bids to a quantity of capacity that is capable of being sustained for two consecutive hours.

For example, a 10MW x 10MWh BESS could qualify with ERCOT for up to 5MW of ECRS and 10MW of RRS.

Minimum State of Charge (SOC)

Similar to the duration requirement detailed above, ERCOT has a 2 hour minimum SOC requirement for ECRS vs. a 1 hour minimum SOC for RRS.

For example, to provide 10MW of ECRS, an ESR would need 20MWh of energy stored in the battery (or equivalent in stop charge capability) heading into the operating hour. However, to provide 10MW of RRS, an ESR would need 10MWh.

Call Rates

ECRS and RRS serve distinct (and at times overlapping) functions for ERCOT and have different triggers under which ERCOT will call on resources to provide the service in actual operations. In just the couple of weeks since launching ECRS, we have already seen ERCOT call on resources providing ECRS on multiple occasions (while that has not been the case for RRS). Based on the current ERCOT market structure and protocols, we expect that trend to continue with ERCOT tapping into resources providing ECRS more frequently than resources providing RRS.

How do these operational considerations impact bidding/allocation to ECRS?

ERCOT’s more onerous operating requirements for ECRS (related to RRS) has the following impacts:

- Reduces capacity bids for a given interval given the duration and minimum SOC requirements

- Reduces the frequency of capacity bids given the minimum SOC requirement and higher expected call rates

- Requires more active SOC management given the minimum SOC requirement and higher call rates

- Introduces more exposure to real time (RT) energy costs given the minimum SOC requirement and higher call rates

- Introduces more uncertainty in the operating day given the higher call rates (or wider band of potential call rates)

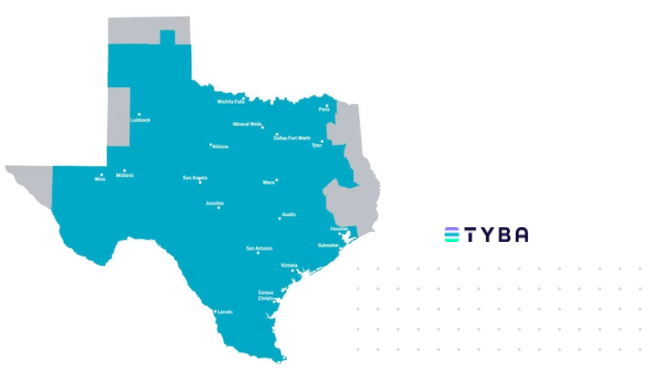

Tyba’s robust optimization framework is able to incorporate these different operating requirements and inform optimal operations for storage resources bidding into ECRS, RRS, and ERCOT’s other products. The graphics below detail daily revenue for an example 2 hour storage project settling at the HB Houston node that (i) includes bidding into ECRS and (ii) does not include bidding into ECRS. Over the ~2 week period, ECRS is primarily displacing Reg Up, along with some RRS and energy arbitrage revenue. Given some of the operating considerations including conservative assumptions around call rates for ECRS, we still see the majority of revenue being tied to RRS.

Additional resources:

- GridStatus retrospective on grid conditions during first two weeks of ECRS.

- ERCOT presentation detailing ECRS product.

- Market readiness workshop, with exhaustive detail on impact to qualification, bidding, telemetry, and reporting protocols.