With NPRRs 1149 and 1186 taking effect this summer, and lower Ancillary Service (AS) prices across the board, energy storage operators have had to adjust their bidding strategies, leaning more heavily on energy arbitrage to bring in sustainable revenue and avoid Failure to Provide (FTP) risk.

Background

Historically, battery energy storage assets in ERCOT have leaned heavily on AS to drive revenue.

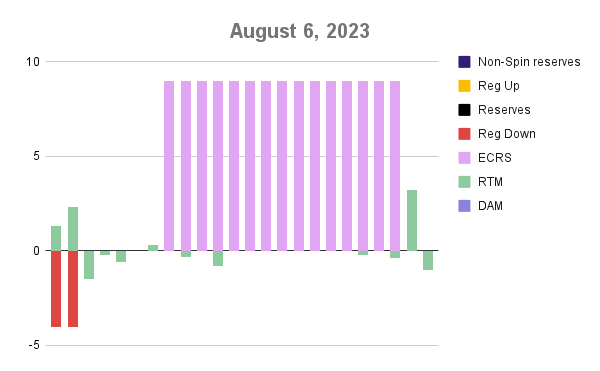

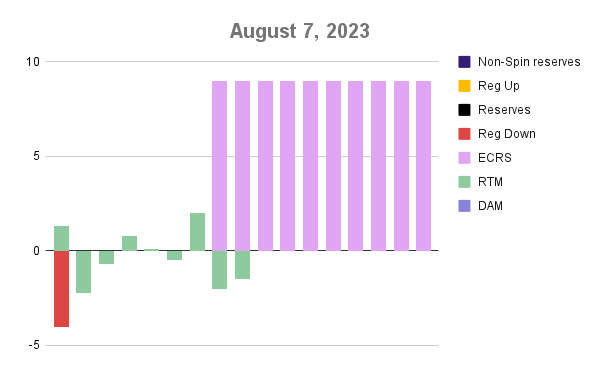

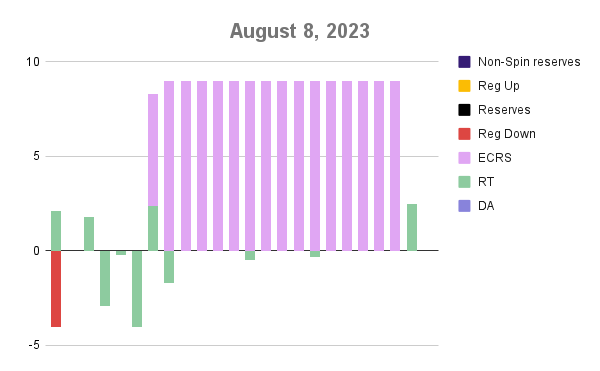

Given the high prices and gray area around FTP penalties, many operators have spent the past year+ bidding similar profiles every day. They commit nearly the entire capacity of their Energy Storage Resource (ESR) into “up” AS products (Reg Up, RRS, ECRS, Non-Spin Reserves) hour-over-hour, leaving little to no ability to take advantage of the real time market. This approach often presumes the asset will not get called for the majority of its AS obligations and thus require minimal state of charge management.

2023 Representative Asset: Market Awards (August 2023)

Stacking obligations in this manner has always been fairly risky, but recent market changes are both increasing the risk, and decreasing the reward.

Generators submit offers to provide energy and ancillary services. ERCOT uses these bids/offers along with grid constraints to determine market clearing prices and provide dispatch instructions.

Shifting market dynamics

This summer brought a new layer of complexity to ERCOT:

- Regulatory changes: NPRRs 1149 and 1186 went into effect, meaning ERCOT now actively monitors assets for sufficient charge levels, both entering and throughout the hour of their obligation. Automatic clawbacks will be levied on assets unable to meet their commitments.

Tyba tip: Factor in uncertain, probabilistic deployment rates when configuring your operating plan – and ensure that your optimizer will adjust in real-time if your asset is unexpectedly called, or real-time prices begin to spike.

- Ancillary Service prices are declining: Overall, settlement prices for AS are down. Regulation Up (Reg Up) prices decreased 46% relative energy1, and ECRS clearing prices averaged 29% lower in July and August2.

With less capacity revenue to be made and higher penalty risk, are operators adjusting their approaches?

Adopting more balanced operating strategies

We took a look at how top storage assets in ERCOT changed their behavior after the regulations were enacted on June 27, 20243,4 – and the correlation with revenue outcomes.

We are seeing two major shifts:

First, AS prices are down year-over-year, with median prices ~53% lower across products.

Revenue mix is also changing – a lot – with the percent of revenue from AS substantially decreasing.

- In the months preceding the regulatory changes, assets net approximately 75% of revenue from up AS products.

- Post-regulations (July and August 2024), up AS products comprised only 41% of revenue.

What’s more, we see a strong correlation between increasing energy bids and total revenue capture.

In this new market where energy arbitrage forms a critical revenue stream, the most successful operators are taking a more balanced approach. However, the timing of AS and energy bids to both hit market peaks as well as be in the right products becomes even more foundational. Since operators are exposed to steeper penalties of overextending in the AS market, they have to be selective about which time periods they commit to. At Tyba, we like to say each bid is like a shot on goal. With limited energy (typically 1-2 hours of rated duration) you only get a few shots on goal each day, so do what you can to ensure each one is on net.

Operating Deep Dive:

Picking the right moments

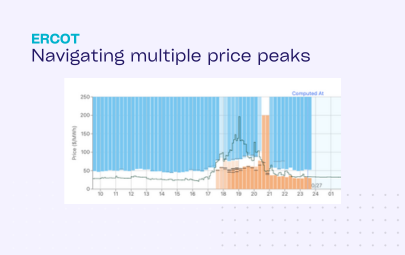

To bring this concept to life, we looked at a specific operating day, August 20, 2024, when one operator was able to discharge into a real-time spike, where prices neared $3k/MWh, and another was not.

Below, we see the first operator was awarded ~90% of nameplate power capacity to ECRS from hours 11-18, whereas the second operator was awarded ~70%.

When real-time prices skyrocketed in hours 19-20, having energy available and the battery’s capacity not fully committed to AS led to a 3x difference in revenue outcomes.

If we look at Asset #5, the battery had a coinciding ECRS bid for ~60% of their nameplate power capacity and had committed additional power capacity to DA energy. In comparison, Asset #2 only had ~30% of their nameplate capacity committed to AS, so was able to discharge into the RT price spike and capture the $3K+ prices.

Forward looking strategy

To drive towards sustained, high revenue going forward, operators will need to:

- Pick the right products in the right moments: AI/ML backed price forecasting and real-time optimization support a data-driven strategy that optimizes across all available market products based on daily conditions.

- Manage state-of-charge: Factor in the expected deployment rate of each AS obligation you are considering to better understand potential revenue – and ensure you will have sufficient charge to deliver on each obligation. This will help avoid FTP charges, including capacity revenue clawbacks, SASM exposure and basepoint deviation penalties.

- Embrace technology: Advanced software and generative models can analyze these data and optimize asset dispatch at the pace required to win in such a complex and fast evolving market – supporting operators and enhancing performance across the board.

Sources: 1. Modo Energy, July 2024 2. Modo Energy, August 20234 3. ERCOT NPRR 1149 4. ERCOT NPRR 1186