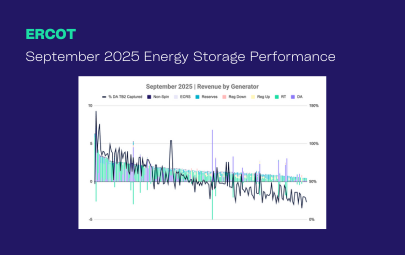

ERCOT is known for its volatility. It is what makes the market so attractive to energy storage operators. On November 10th, there was an unexpected, late evening price spike where Real-Time (RT) energy prices neared the market cap of $5,000 that took many by surprise. After a low-revenue summer, with the average battery earning 85% lower revenue compared to July 2023, this day provided a reminder of how quickly market conditions can shift, and how critical it is to remain agile.

Leveraging a sophisticated AI/ML-powered price forecasting and optimization engine can make all the difference in capturing these revenue opportunities. The technology is uniquely equipped to anticipate market shifts, and execute an operating strategy that captures high prices while maintaining reliability and compliance.

Factors Contributing to the November 10th Price Spike

- Low net load + consistent energy demand

Thermal outages remained steady throughout the day and wind production was low, which limited available energy supply. At the same time, net load was slow to decline in the early evening as solar generation ramped down, leaving the SCED with <2GW of available capacity. This combination of steady demand and constrained supply meant there was not much of a safety net left by the evening.

- BESS capacity depleted in earlier hours

The bulk of energy storage units discharged too early, from 5:30-7pm CT, with net output peaking at over 4.2 GW at 5:55pm. Only 55% of that capacity (2-2.5GW) was discharging into the market peak at 7pm, and only a subset of that discharge would have been exposed to the RT price, depending on each operator’s DA bidding approach.The broader fleet was likely targeting the elevated prices earlier in the evening because, on previous days and in the DA market, peak hours were earlier in the evening. Regardless of the reason, it left many batteries with limited or no charge remaining to hit the true market peak.

- Ancillary Services were deployed earlier

There were substantial Regulation Up (Reg Up) deployments around 5pm, depleting the energy capacity of obligated assets. Then, with limited real-time capacity available to the SCED, ERCOT Contingency Reserve Services (ECRS) was deployed, with the greatest release ~7pm. As ECRS committed resources were released, their energy offer curves likely pushed the price higher creating the price speak at 7pm.

With demand remaining and low capacity available to the SCED due to high BESS deployments earlier, prices skyrocketed, nearing the market cap across zones.

Capturing the Peak Prices

In this instance, a tailored DA bidding strategy and continuously updating price forecasts were invaluable. Tyba’s platform recognized the potential for a late evening RT price spike, and shaped a bidding plan that left flexibility for RT operations. By keeping AS bids conservative, our automated strategy ensured enough state of charge was available to take advantage of a high-price window if it materialized. As the operating day unfolded and the probability of an evening RT spike increased, the platform continued adjusting operations to meet that anticipated peak, aligning strategy in real-time to capture maximum revenue.

How November 10th played out:

Day-Ahead:

Forecasts show probabilistic potential for elevated RT energy prices. This informs the operating strategy, ensuring we do not overcommit to AS or bid into DA energy in the hours leading up to this interval. That way, we allow the flexibility to maneuver in real time and capture the spike.

Operating Day: ~15:00

RT reforecasts show an increased probability of a real time price spike ~IE19/20.

Operating Day: ~19:15

The asset is able to discharge near maximum power capacity, into the high real-time energy prices.

November 10th exemplifies ERCOT’s unpredictable nature and the need for robust tools that can both pick up on anomalies, and enable real-time adaptability. High revenue periods are difficult to predict, but flexible strategies and tools that enable real time adjustments can increase the odds of maximizing revenue when prices spike.

Sources: GridStatus.io,Tyba Platform