ERCOT has been one of the fastest growing markets for energy storage, with over 2GW of operating storage assets as of the end of 2022 (up from 833 MW in 2021). The first wave of storage projects deployed were largely 1 hour duration and primarily bidding into the Responsive Reserve Service (RRS) market. Over the past year, there has been a shift to 2 hour duration projects, largely driven by evolving requirements in ERCOT’s ancillary services market. Likewise, longer duration resources provide more operating flexibility to shift from an RRS/ancillaries-only approach to more energy-centric bidding strategies.

While RRS has been lucrative to date, with the rapidly expanding fleet of storage assets going after a finite volume of RRS (typically <3 GW per operating hour), we expect to see a shift in operating strategies that are more balanced across other wholesale market opportunities. Given that, we wanted to understand how an energy storage resource with an energy-centric bidding strategy could have performed in the ERCOT market. Some key questions we had in mind are:

- What revenue could you potentially generate from energy-only strategies and what value uplift do you achieve moving from DA => RT => DART?

- Are there nodes/regions that are clear winners? Has that changed over time?

- How important is capturing value during extreme grid conditions to the overall revenue opportunity?

To do that, we simulate operations of a representative storage resource under the following conditions.

- Strategies: Day-Ahead (DA) energy only, Real-Time (RT) energy only, DART co-optimized

- Period Evaluated: Jan 2019 through Dec 2022

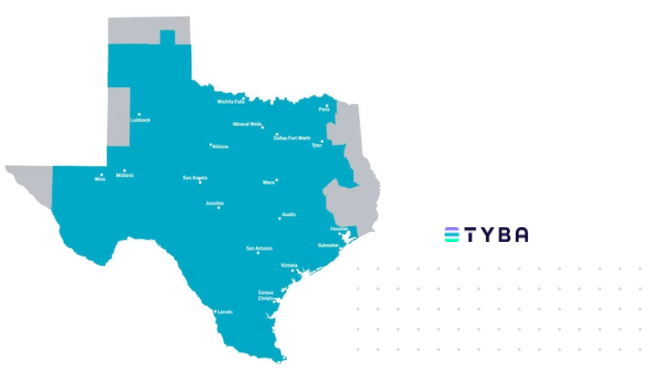

- Nodes: Included 400+ generator nodes across ERCOT. We excluded newer generator nodes given the requirement for 4+ years of historical pricing history.

Other assumptions:

- 2 hour duration

- 92% charge and discharge efficiency (or 85% RTE)

- Perfect foresight case with no virtuals enabled

- All revenue values are represented net of charging costs and normalized to $/kW-mo

What revenue could you potentially generate from energy-only strategies and what value uplift do you achieve moving from DA => RT => DART?

Under a DA only strategy, the median node in ERCOT could generate nearly $6/kW-mo over the 4 year window. We see a substantial increase in revenue opportunity ($2.33/kW-mo) moving from a DA-only to RT-only approach. Likewise, there is an additional $2.60/kW-mo moving from RT-only to DART.

Are there nodes/regions that are clear winners? Has that changed over time?

To help drill down on this, we bucketed each node with its corresponding load zone in ERCOT, and compared the median performing node within each load zone. The median node in Houston followed by the West zone consistently performs better than their counterparts in the South and North zones.

While the median value is helpful, specific nodes may be outliers. In the table below, we isolated on the DART strategy and looked at the top (high), median, and bottom (low) performing nodes by year. The Houston and North zones display pretty tight performance bands (<$2/kW-mo spread on average). The South and West zones display much greater spreads between the top and bottom performers.

Looking at the top 10 performing nodes across years, we see repeat “winners” as well as clustered county and zonal performance.

How important is capturing value during extreme grid conditions to the overall revenue opportunity?

Energy storage can be a “hits” business, with specific days/events driving a substantive portion of the overall revenue opportunity. The graph below details revenue (in $/kW) per month over the period spanning January 2019 to December 2022.

There are five months over the past 4 years that each represent >5% of the total revenue opportunity during that period:

- August 2019 – Two EEA Level 1 events called.

- September 2019 – Heat wave combined with forecasting errors led to RT prices at the market cap.

- February 2021- Extended EEA event during Winter Storm Uri.

- May 2022 – Set an all time peak demand for May which was nearly 9GW higher than May 2021.

- July 2022 – Second hottest summer on record in Texas and set an all time peak demand on July 20.

A key contributor for 2020 being substantially lower revenue opportunity compared to the other years evaluated was the lack of extreme events. As you think about applying this to future years, pressure test assumptions around extreme events and see if/how your forward curve provider is capturing these in out year projections.

Takeaways

- Location matters for energy. When building your investment thesis for a project, understand how wholesale energy revenues could supplement ancillary services and how that value may change as you move across load zones and congestion pockets. Through Tyba’s modeling platform, you can replicate this analysis and dive deeper into locational specific insights and energy price drivers such as congestion.

- In addition to being a valuable grid resource, supporting the grid during extreme conditions can be a major revenue driver. Through Tyba’s modeling platform, you can simulate performance using historical price predictions (Tyba’s and/or your own) to understand how predictable these extreme events are and defend the ability to capture that going forward.