Overview of the market products available in ERCOT with insight into how they are best used, and demonstrative outcomes from recent months.

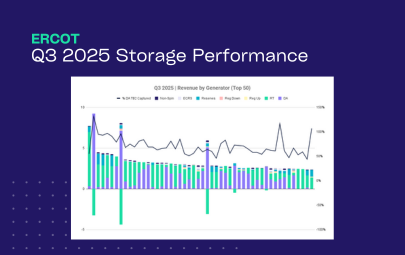

Companies operating energy storage assets in ERCOT see a wide range of outcomes. In 2023, top performing BESS netted 2-3x1 higher revenue than median and low performing assets respectively. Given the volatility of the market, successful operations require dynamic balancing across energy and ancillary services products, as well as proactive state of charge management.

In this post, we discuss ERCOT’s market products, what each is best leveraged for, and how they connect to revenue outcomes – including real examples from this summer (May-August 2024).

Optimizing Bidding Strategies:

ERCOT’s Day-Ahead Market (DAM) and Real-Time Market (RTM) provide multiple avenues for energy storage operators to offer their assets into the market. Likewise, storage resources can generate revenue from energy arbitrage (charging when prices are low, selling when they are high) and ancillary services.

Balancing participation across the DAM and RTM as well as energy arbitrage and ancillary services is critical.

Day-Ahead Energy: Locking in Stability

The day-ahead market offers a degree of predictability, making it a foundational tool for stabilizing returns. Operators who bid into day-ahead energy secure prices and hedge against sudden fluctuations in real-time pricing. In many instances, day-ahead prices exceed real-time (for example, demand doesn’t reach forecasted levels, or more supply is available than ERCOT anticipated), making it a core revenue driver.

Summer snapshot:

Heatwaves in late June 2024, for example, caused day-ahead prices to spike as much as 60% higher than real-time energy prices.

Real-Time Energy: Seizing Volatility

The real-time energy market, while more unpredictable, offers opportunities to capture outsized returns, especially when reserves are tighter than expected. Successful real time bidding requires the ability for rapid adjustments based on continuously updating grid conditions and corresponding price forecasts.

Summer snapshot:

During the August heatwave, real-time prices spiked to over $5K per MWh, allowing operators who were positioned to respond swiftly to bank significant revenues.

Ancillary Services: Unlocking Value in Grid Support

Ancillary services act as an offer to support grid reliability by providing supplemental capacity that can be called on by ERCOT to manage frequency and other supply/demand challenges. Ancillary services can provide steady revenue streams while minimizing cycling – so bidding into them both provides a return while extending asset usable life.

Storage assets participating in Regulation Up (Reg Up) and Regulation Down (Reg Down) services provide fast-response energy to balance the grid within seconds of ERCOT’s call. Revenue from regulation services can nicely supplement that from energy arbitrage. ERCOT Contingency Reserve Services (ECRS) provides energy to respond to major grid events, such as system-wide frequency deviations or unexpected ramping challenges.

Storage assets may also participate in services to help ERCOT maintain grid stability. Responsive Reserve Services (RRS), for example, requires resources to be available within a few minutes to maintain system frequency. Non-spin provides backup generation or demand response capacity that can be brought online within 30 minutes during grid emergencies.

ERCOT is also planning to add a new service, Dispatchable Reliability Reserve Service (DRRS), designed to provide additional dispatchable reserves that have longer duration (4+ hours) run times.

Summer snapshot:

Storage operators who offered capacity in ECRS during the June 2024 heatwaves saw payouts increase by up to 40% compared to average months.

State of Charge: Dynamic management for risk mitigation and profit maximization

State of Charge (SOC) management is one of the most critical operational components of an energy storage asset. Effective SOC management ensures that assets have the optimal amount of energy available to capitalize on market opportunities, such as price spikes in the real-time market and deliver on all ancillary service obligations.

ERCOT has also implemented a number of new regulations in recent months aimed at enforcing grid reliability. The grid operator will be requiring greater visibility into an asset’s ability to deliver on their obligations – and penalizing those who cannot.

Summer snapshot:

On May 8th between the hours of 7-9pm, we saw sustained, higher than normal ECRS deployments. Operators who bid aggressively into ECRS in consecutive hours saw depleted SOC rendering them unable to bid into the $3K+ real-time energy price spike that evening, and risking Failure to Provide for their subsequent obligations.

How to win:

Start with accurate forecasts that are able to inform your bidding strategy. This will help allocate the right amount of capacity to the day-ahead market, accounting for load, weather conditions, grid constraints and more. Next, ensure your optimizer monitors the market at all times, and is able to automatically bid into price spikes, then programmatically adjust the operating strategy to ensure adequate state of charge for upcoming AS obligations.

This optimization is incredibly complex and ever changing. Doing it well – which maximizes revenue and removes risk from your business and burden from your team – requires advanced technology. Tyba can help.