High volatility makes ERCOT an incredibly high potential revenue market for storage asset operators. However, it also makes it challenging to balance revenue maximizing activities with state of charge management. Batteries have a finite energy and power capacity – so allocating that energy and capacity to the right market products, at the right times, is the only way to see those thousand+ dollar per MWh returns hit your P&L.

Discharge too early or commit to too many ancillary service obligations in subsequent hours and you may:

- Inhibit your ability to discharge into a real-time price spike

- Be forced to charge into high real-time prices

- Run out of energy and fail to deliver on an existing AS commitment

Let’s take a look at each of these scenarios, and how they could impact operator revenue.

Discharging into real-time price spike:

Grid conditions can get tight quickly in ERCOT. Perhaps temperatures are particularly hot or cold, renewable generation assets are ramping down production in the early evening, or other asset types unexpectedly pause production.

Since ERCOT is a market where prices reflect the balance of supply and demand, this causes real-time energy prices to increase. Storage assets are uniquely positioned to capitalize on these spikes given their ability to quickly store and dispatch energy. If you have energy in the tank, these real-time price spikes can deliver outsized returns.

Let’s look at a simple example:

You have a 100MW, 2-hour duration battery. Real-time energy prices rise from $1000-$4000 between hours 19-21. RT prices are produced at 5 minute intervals but, for the sake of simplicity, let’s say they increased at a consistent rate.

- If the asset was full when prices begin to increase, you could make ~$5000 over the two hours

- If you only have a portion of your capacity available to discharge because, maybe you discharged in a preceding hour, have a Reg Up obligation that hour, or have an obligation in the next hour or so, your revenue outcomes would be diminished.

Forced charge:

Now, what if you had an existing obligation in a future hour, but discharged into that price spike anyway? It could work if prices come back down quickly, or you could have to charge into a high priced hour to refill your asset so you are able to deliver on the obligation you have coming up.

Running out of energy:

Since assets with AS obligations are not always deployed, some operators chose to offer much of their capacity, in multiple consecutive hours – or carry a low SOC despite having upcoming obligations. This approach carries numerous risks.

- Failure to Provide: levied at the top of each hour when ERCOT looks at total capacity available (as measured by the High Sustained Limit (HSL)) at a given QSE to ensure it matches the AS awards granted for that hour the day before.

- Failure to Perform: assessed when ERCOT needs the QSE to deliver on the AS awarded, but they are unable to. If this happens consistently, the provider may be subject to major penalties, including blacklisting

- Supplemental Ancillary Service Market (SASM): a last resort market used by ERCOT to procure additional AS when there is an unexpected shortfall. Assets unable to meet the AS obligations offered in the day-ahead market when a SASM is called can be subject to pay whatever the market clearing price is to cover their obligation. SASM prices are uncapped and typically far exceed the capacity price.

One operator we spoke with recently recounted that in a past role, a single SASM wiped out a year’s worth of revenue.

Case study: August 2023

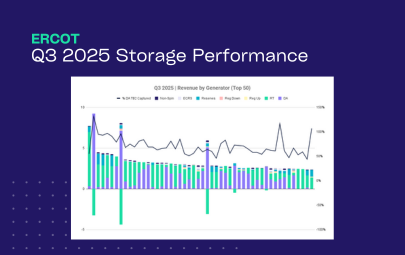

We examined the approaches of top performing assets and found that, with these new regulations implemented, they will have to adjust their operating approaches to comply.

Below accounts just for FTP penalty – if a SASM had occurred, losses could skyrocket for assets unable to meet their obligations.

Learn more about the operating strategies of top performing storage assets during the summer heatwave.

Evolving regulations are heightening these risks.

Two new NPPRs crack down on assets having the state of charge required to meet AS obligations going into, then throughout, the operating hour.

- NPRR1186: QSEs must report SoC for the storage assets and have sufficient SOC to cover all ancillary service awards. Shortfalls will limit RT energy actions that operators can take.

- NPRR1149: A clawback will automatically be levied on assets that are unable to meet their AS obligations, with potential exposure to uncapped SASM prices.

A third new NPRR increases the likelihood of ECRS deployments, which could subsequently decrease RT price volatility.

- NPRR1124: ERCOT can manually release up to 500MW of ECRS capacity from the SCED when energy demand exceeds dispatched supply by 40MW or more, for 10+ minutes.

Together, these shifts confirm that operators will have to be highly strategic in how they allocate their assets.

State of charge management isn’t just about keeping the batteries ready—it’s about strategically managing when and how much to charge or discharge based on market conditions. To maximize risk-adjusted revenue, operators need a strategy and optimizer as dynamic as the ERCOT market – able to forecast prices by product, and dynamically adjust dispatch strategy, accounting for both revenue and state of charge considerations.