Case Studies

Breaking down April 20 in ERCOT

Low wind output, high net load, and a market notice limiting outage timing led to interesting price formation in ERCOT.

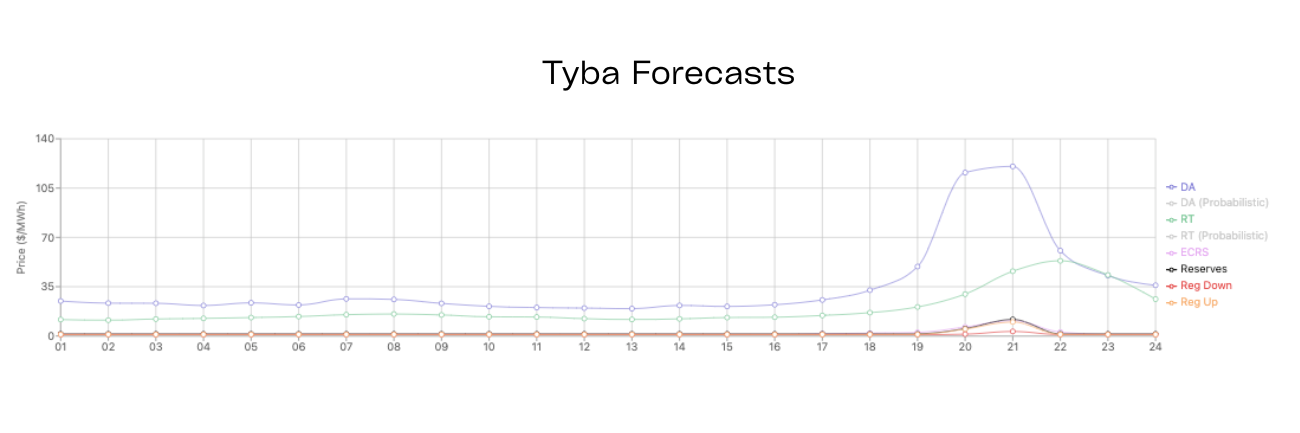

Sunday, April 20, 2025 was one of those days that had storage operators glued to their dashboards. Forecasted low wind production combined high outages were key factors leading market participants to believe interesting price formation was coming.

Here’s a breakdown of what happened — and how operators could have maximized returns.

What happened?

ERCOT came into the day projecting low wind output and high net load during the evening solar ramp-down. That alone had many anticipating elevated prices during the 7–9 PM window.

For this reason, ERCOT issued a market notice requesting resources to delay outages until after 9pm, signaling system stress and making it clear that flexibility would be valuable.

7-9pm

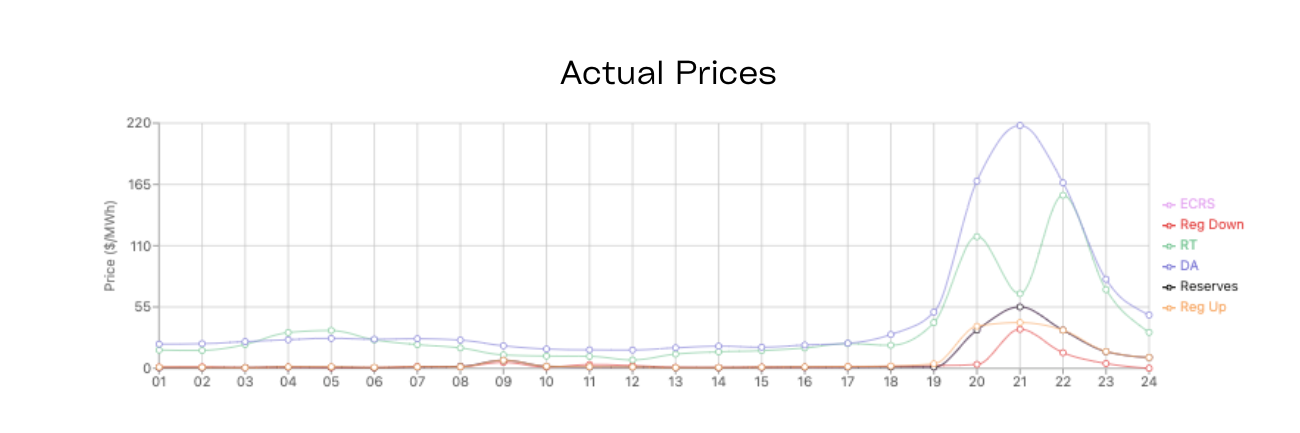

As solar began to ramp down, Day-Ahead (DA) energy prices cleared at a premium over Real-Time (RT) across ERCOT. During this period, storage participation was strong, with net output peaking around 5.4 GW.

*Gridstatus.io, 2025-04-20, HB_HUBAVG

After 9pm

As soon as the outage moratorium from the market notice was over, 2-4GW of incremental outages went into effect. This reduction in supply was exacerbated by wind underperforming relative to forecast – further reducing supply – and Physical Response Capability (PRC) dipping, and remaining, below 7GW.

With low supply and limited buffer in the system, Real-Time energy prices shot up, hitting $300-400 across most of ERCOT.

Effective operating strategies

While these market fundamentals applied to much of ERCOT, we did see a bit of variance across zones. This is clear if we look into the South vs. Houston Hubs during the evening of 4/20/25.

South Load Zone

In line with the majority of ERCOT, the highest prices of the day were in RT energy, peaking near $400 between 9-10pm. The second highest priced hour, though, was 8-9pm, and DA energy prices exceeded RT, coming in at ~$225.

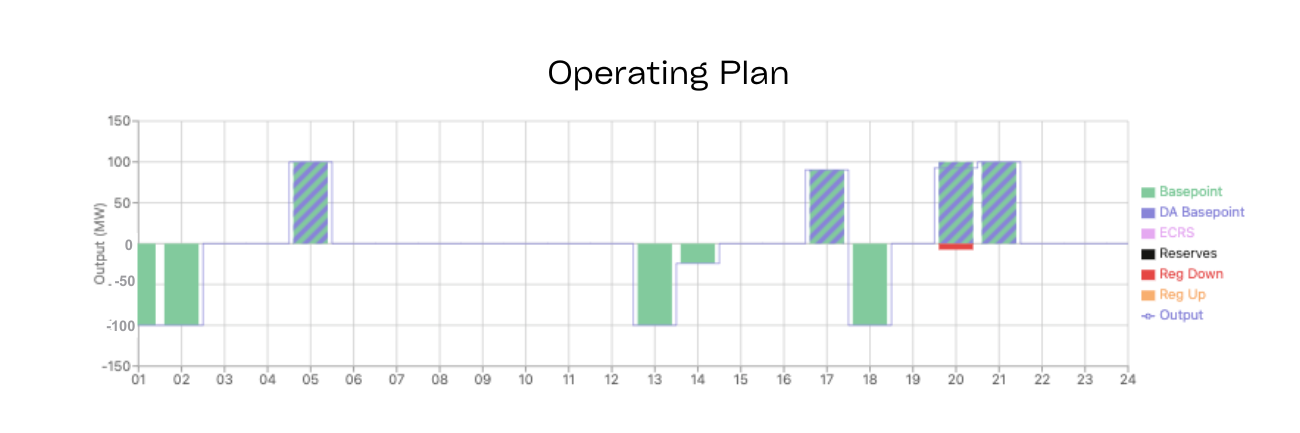

In this environment, an effective operating strategy would:

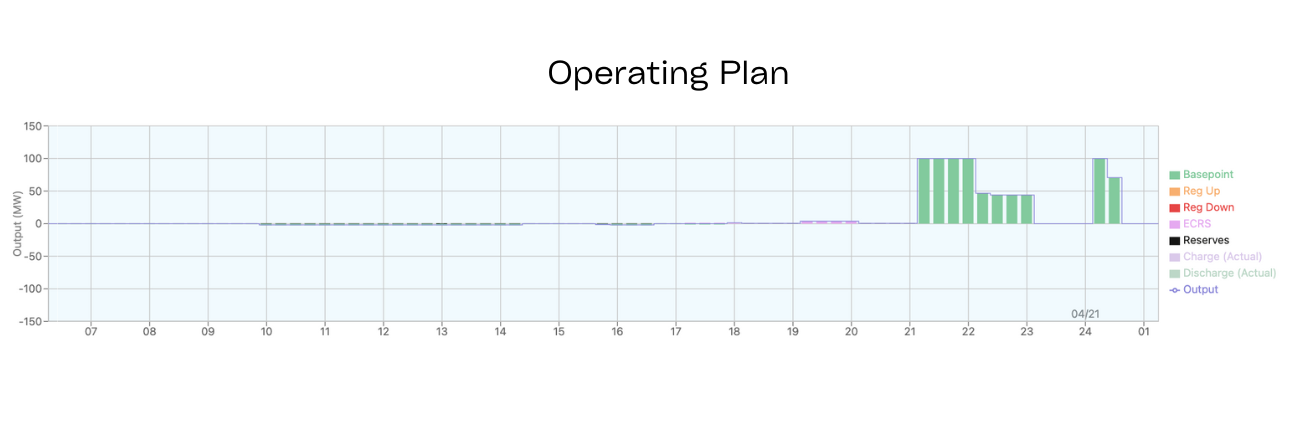

- Ensure the asset is fully charged before the evening solar ramp-down period

- Discharge into RT energy 9-10pm to capture the daily peak

- Bid/clear into DA energy and/or Ancillary Services (AS) around that peak period

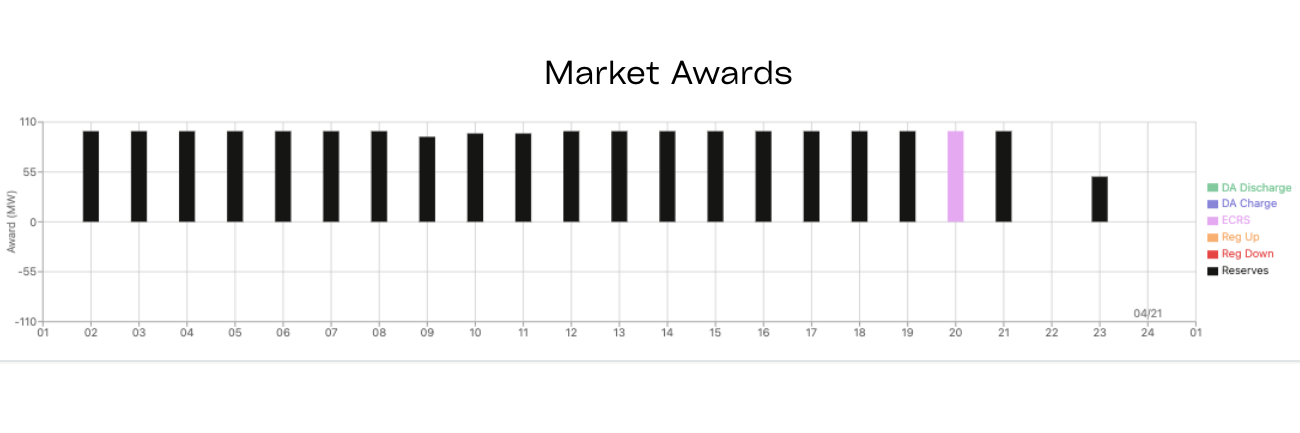

Why might the AS-forward approach make sense in this scenario? In this case, we were able to clear into Reserves and ECRS, collecting capacity payments over 22 hours of the day. Overall, this strategy was more risk averse and still produced good results.

Sample operating strategy | Hub South

Houston Load Zone

Prices at the Houston Hub looked a little different on this day. DA energy prices cleared higher than RT across the key 7-10pm hours. The trick is – we only know this in hindsight.

Effective operations here would necessitate:

- Highly accurate, nodal-specific forecasts that called the DA price premium

- Bid/clear DA energy for 8-9pm along with either 7-8pm or 9-10pm

- Discharge the battery in RT to cover DA positions and/or collect DART spread